Payroll tips can include everything from increasing business efficiency to making sure you comply with international law.

Payroll services covers processing, data tracking, expenses and benefit and tax compliance. The global payroll software market is a significant industry in its own right – predicted to hit 52 billion by 2030!

Overall, a business cannot work efficiently and properly without a smooth-running payroll department. It’s crucial to pay people accurately, on time, factoring in overtime and flexible hours – all while looking after their data.

We’ve put together our top payroll tips to help you get it right.

Biggest Payroll Tips For Small Businesses

1. Check The Law In Your Country

Different pay and tax laws exist from country to country.

The first and most important payroll tip you need to know is to fully understand how it works in your region or territory.

Payroll doesn’t just affect the transfer of money for wages, it might mean that you’re obliged by law to make pension contributions or similar.

The rules differ significantly from the US, to the UK, to Europe, to Australia, so make sure you engage accountants to advise and ensure compliance.

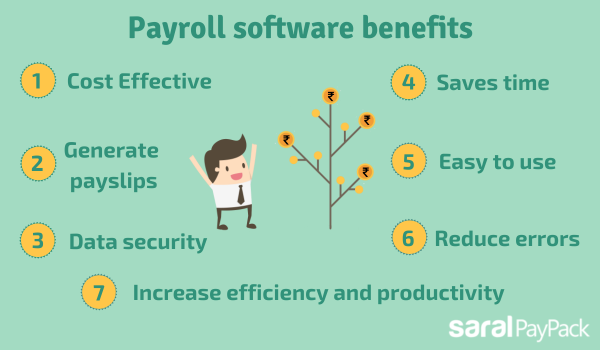

2. Choose Reputable Software

Nowadays, it’s extremely unlikely that you’ll be conducting payroll manually, without relying on some kind of payroll tool or software.

This in itself is an expense, and the best type of software would be something that gives you an overview, but also gives your accountant (or company accounts team) a separate login, so they can ensure you’re doing everything correctly.

Ideally, your software will integrate with other HR processes such as holiday or absence management.

3. Invest In Privacy

A crucial part of payroll is privacy and security.

This can take two formats:

For example, it might be awkward if every person knew everyone else’s salary through a slip or error with some data.

This mistake could destabilise your office, as it’s likely people would take issues with someone else’s pay (although there is a debate make pay rates more public anyway).

Even more seriously…

The really, really big error with a lack of privacy would be to leak someone’s payroll number, social security number (national insurance number in the UK), or any details like their address or date of birth.

This could result in identity theft or fraud, so you need to ensure that you are not accidentally leaking this kind of information.

When you run payroll, you have incredibly important data on your hands to protect, so invest in the best firewall software, layers of IT security, and have systems in place to stop leaks.

4. Update Employee Information Regularly

One of our crucial payroll tips is to make sure that all the information about your employees is fully up to date.

Again, this has security implications, if for example sensitive material was sent out to an old address.

You also want to get the numbers right every time, so make sure updates are done instantly as people’s salary increases to reflect accurate job information and rates.

5. Correctly Configure Reporting And Analytics

Reporting and analytics are crucial to your operations as a business, and payroll is no different.

People are one of the biggest expenses for any business, so you should be running reports that can spot trends and project where you’re going in the future.

Your should choose a payroll system that enables simple reporting and analytics.

6. Track Time Off Balances

Integrated into your payroll system should be time off and holiday balances.

Not only will it help you deliver without errors, but will allow your business to plan ahead by predicting when you’re likely to have to employ freelancers or contractors to plug gaps.

7. Use A Payroll Calendar

One of the biggest payroll tips is to never deliver late.

You have no idea when each individual’s own direct debits or expenses are paid, and the last thing you would want is for someone to default on their rent or bills as a result of your error. A payroll calendar should be used to make sure you pay consistently every month, by whatever rules you decide.

For example, paying on the last working day of the month needs to be something you can stick to so you don’t cause unwanted issues for your employees.

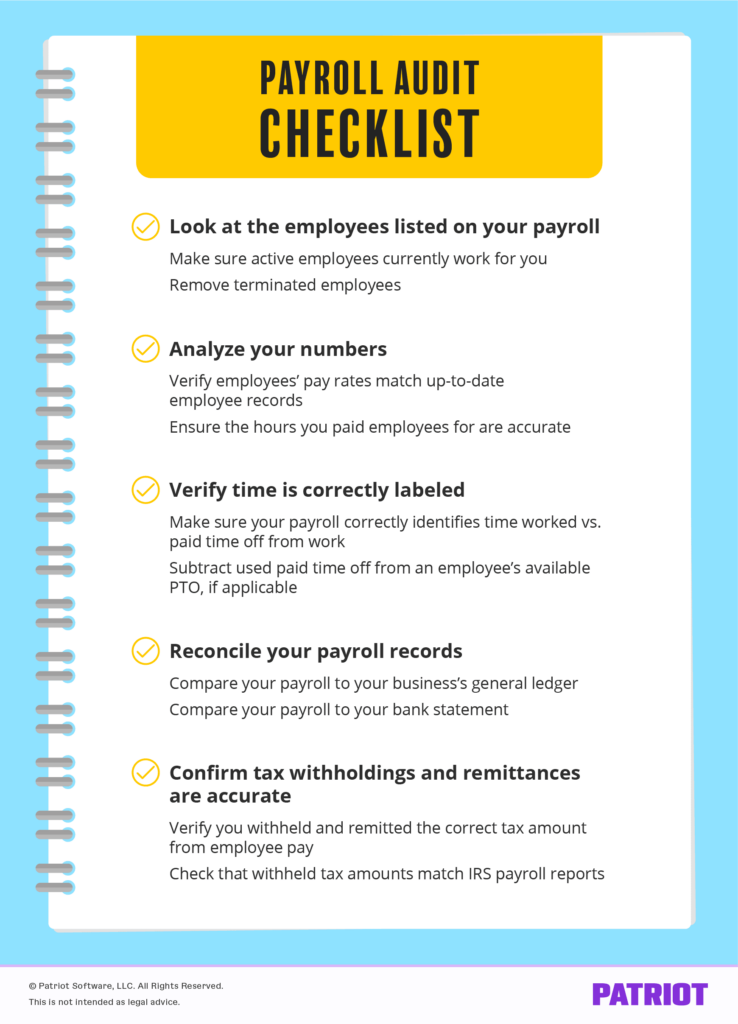

8. Start A Payroll Checklist

One of the best payroll tips to stay as organised as possible is to consider using a payroll checklist. This will make sure that every task is completed and approved, prior to payment.

Here’s a Payroll Checklist example:

9. Track Expenses With A System

If your employees regularly run up expenses which need to be reclaimed, then this should be integrated with your payroll system, to keep all the financial oversight in one place.

You can set up a tracking system for expenses using many of the best payroll software tools.

10. Review Industry Rates

Payroll and HR should be more comprehensive than simply dropping money into bank accounts. Part of payroll to to make sure you review regularly to ensure you’re paying competitive, fair industry rates.

This will help with retention and reputation.

11. Consider Outsourcing

There are thousands of professional payroll providers who will help you get everything spot on in terms of your payroll system.

Outsourcing the entire task is the way that many businesses choose to move forward, ensuring they pass on responsibility to a company who knows the legalities and ins and outs of the legal framework.

Consider outsourcing payroll to a professional payroll service provider.

12. Come Up With A Benefits Plan

Many company benefits go further than pay alone. These help recruitment, retainion and your business reputation.

Consider offering extras such as insurance, pension pots, bonuses or employee reward programs.

These can vary from monthly bonuses and commissions, to a year end stipend for your people.

13. Identify Cost Savings

As one of the biggest expense areas for any business, running the numbers on payroll can help you strategically plan your business.

Make sure you have clear oversight of the data, how it’s changed over time, and add these numbers alongside other financial targets.

This is often one of the first areas targeted by businesses after a take over.

14. Integrate HR & Financial Platforms

Payroll is a big part of HR, but by no means all of it.

Different parts of your financial system should speak to each other, so make sure they integrate.

You can find comprehensive all-in-one payroll and accounting software, but if you’re using a standalone tool, make sure it fully integrates with other HR, financial, and CRM systems.

15. Consider Flexible Pay Frequencies

Most companies use a monthly payroll system so they don’t have to run it all the time.

However, depending on your workforce, or the size of your business, you might choose to offer staff a different schedule, such as weekly or biweekly pay.

This can benefit individuals within your organisation and be another positive reason to be part of your company.

Ultimately you want to examine the options and make sure you go with the one that suits you – and your people – the best.

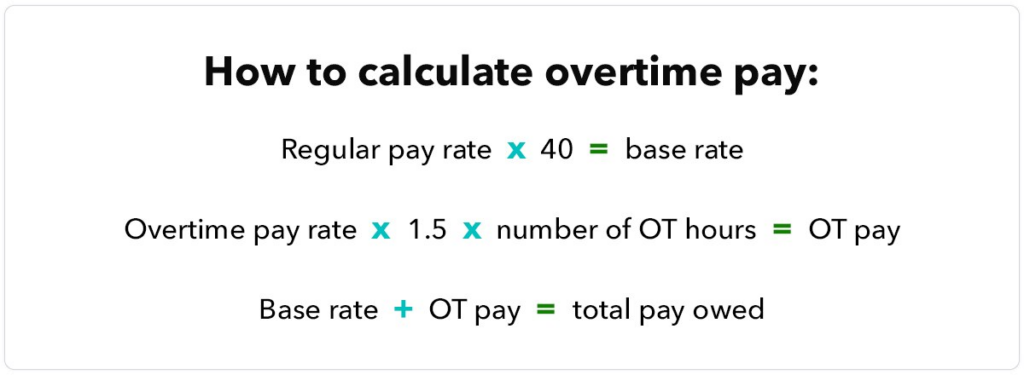

16. Calculate Overtime Hours

Overtime hours get more complicated, especially when they come in a different rates.

This is common in areas like hospitality, where people might be paid double time.

Alternatively, there might be some variable for working national holidays or covering shifts.

Make sure that your payroll software isn’t too rigid to track and calculate overtime hours.

17. Regularly Review Process

As software improves over time, and your workforce undergoes a turnover, you’ll need to review process to make sure that everything is still working efficiently.

You should review processes every three months at least.

And also encourage feedback from people in the process, which might highlight areas for improvement.

18. Respond Quickly To Errors

Payroll tips are designed to cut out errors.

However, we are all human, and errors probably won’t disappear completely. You just need to make sure they are small when they do – and rectify them quickly.

If a big mistake does happen, act fast!

You need to be fully transparent with anyone who it may have affected, and then put in processes to make sure it doesn’t happen again.

19. Benchmark Diversity & Equality Initiatives.

Payroll data can tell you an awful lot.

One of the big areas is in DE&I initiatives – specifically around equal pay.

A look at your overall payroll will highlight unfairness in your system.

Then, you can work to rectify this.

Payroll Tips: The Most Common Payroll Mistakes To Avoid

Following our best payroll tips, here’s a quick summary of the biggest mistakes to avoid.

Double check the numbers

It’s actually quite easy to make small errors resulting in huge losses, thanks to something as simple as a number or decimal place being wrong.

If this results in overpayments of underpayments, it can cause a whole lot of issues for both your business, and the employees on the receiving end.

Mixing pay frequencies.

We advise that it’s best to keep all your employees to the same pay frequency – i.e monthly, or weekly.

If you mix it up, things can get complicated.

That, in turn, will lead to more errors.

Legal Compliance

Not being on top of the legal side can cause difficult issues for both sides.

If you’re a multi-national, tax and benefit laws will be different in different countries, so it’s important to get experts on the case who will stay up to date with any legal changes.

Paying late

This is not just a serious clerical error, it can cause people big issues.

It might be that they miss a rent or insurance payment as a result. It’ll also create mistrust in your relationship, and could lead to people leaving.

Make sure people are paid on time, and accurately.

Lack of documentation

Your payroll records need to be kept, not just for you and your own tracking. Whether it’s an audit or just general tax compliance, you need accurate documents at all times.

Security breaches

Not taking the appropriate steps to safeguard your employee and company data is a serious mistake.

Losing your data will cause your business issues.

Losing your employee data could be even worse, resulting in mistrust and anger in your team.

Use security measures like best password protection advice, encryption, firewalls and keep on top of your sensitive payroll data.

Thanks for reading our best payroll tips, if you found this article useful, please share and subscribe to our channels @thesoftwarepig.

Good luck!